A Healthcare Flexible Spending Account (FSA), along with its siblings, the Dependent Care FSA, the Limited Purpose FSA, and the Commuter Reimbursement Account (CRA), is one of the smart and easy ways employees can get out in front of rising healthcare costs and medical bills, saving money. FSAs are set up as tax-advantaged accounts, so participants can save up to 40% on thousands of eligible everyday expenses.

An FSA can be a strategic tool for your organization, offering financial advantages to both employees and employers, while contributing to a positive workplace culture and attracting top talent.

One in four Americans report in multiple polls that the biggest concern facing their families is high medical bills. It is not as uncommon as people think for families with insurance, and without any major medical issues to struggle and stress over mounting bills .

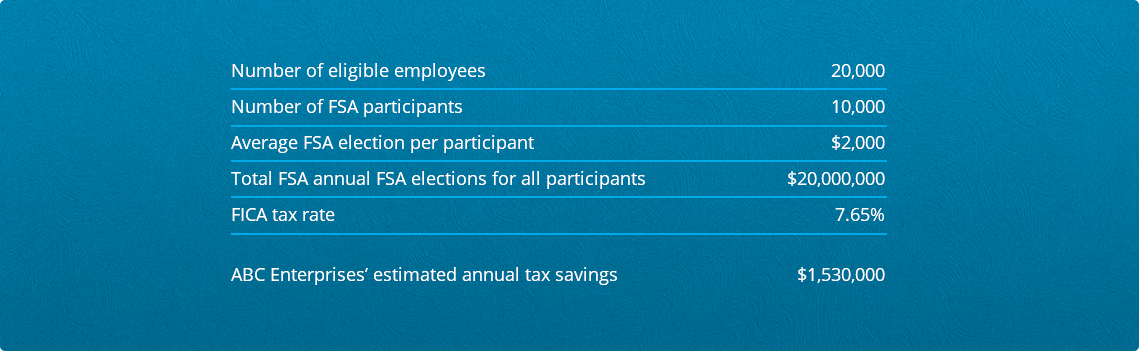

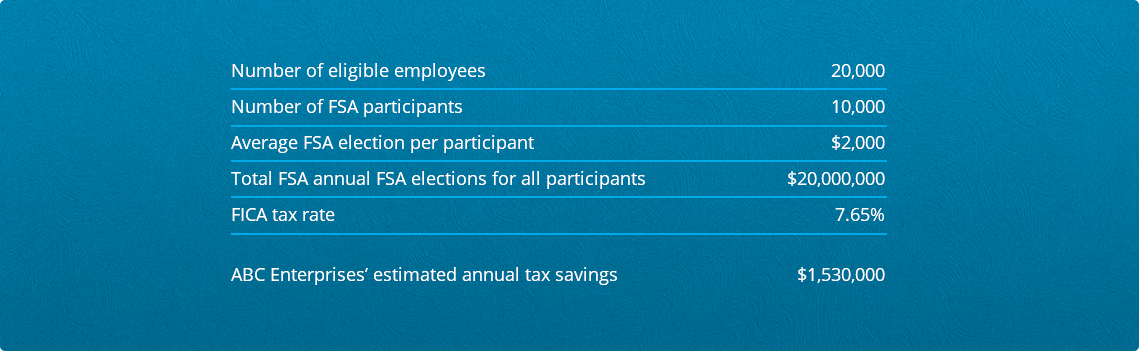

Because FSAs are pre-taxed, the taxable incomes of your employees are reduced to the point where you have a tax-saving opportunity on payroll and FICA taxes equal to that of the tax on the employee’s payroll deduction. Essentially, it’s a no risk, no reward situation: the more employees you have participating, the greater the FICA tax savings.

Sample employer savings: Let’s say that ‘ABC Enterprises’ has an FSA with Ameriflex.

Let’s run through their numbers:

Eligible expenses include those related to medical, dental and vision that are not covered or previously reimbursed by an insurance plan. Need to know what an FSA can be used for? Do you know where you can purchase items with your FSA card? Here is a comprehensive list of expenses and links to the FSA store.

The most common FSA is a General Purpose FSA, where any qualified medical expense (find the full list here), can be expensed through an FSA account. Other FSA options that you can combine with, or have as standalones, are:

Dependent Care FSA: Paying for childcare or dependent adult care is a burden that the Dependent Care FSA takes care of for your employees. This includes anything from daycare, summer camp, and of course, the care of elderly dependents. Because the cost is deducted pre-tax from employees’ paychecks, they have the potential to save thousands each year on taxes.

Limited Purpose FSA: This type of FSA helps an employee save on vision and dental costs, similarly to how the General Purpose FSA works – the employee estimates how much they will spend over the year, and elect for that amount of coverage. A percentage is then automatically deducted from their paycheck.

Commuter Reimbursement Account: A CRA helps to set aside pre-tax dollars towards parking and mass transit expenses. Employees decide on a monthly basis how much to contribute, and then unused funds roll over to the next month – however, the funds are not portable and don’t “commute” with them to a new job.

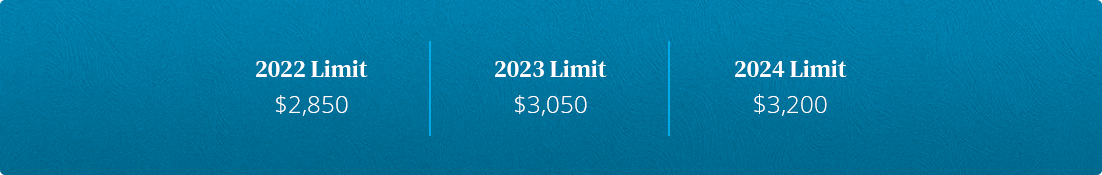

There is a limit imposed on annual salary reduction contributions to FSAs, effective for plan years beginning in or after 2013. For the 2024 plan year, the limit is $3,200. Again, failure to comply could have consequences – a plan offering a health FSA that fails to comply with the limit will lose its tax-favored status.

The limit applies to health FSA salary reduction contributions. Nonelective employer contributions to a health FSA, like matching or seed contributions, flex credits, or other contributions of that nature generally don’t count towards it.

For federal tax purposes, the term “spouse” includes all legally married same-sex or opposite-sex spouses. Individuals in registered domestic partnerships, civil unions, or similar relationships are not considered spouses.

How to reply: You can’t not afford it! The savings alone make it more affordable than paying out of pocket. What you can’t afford is hefty medical expenses for you and your family – with the FSA, pre-tax dollars (aka money saved) are coming out of your paycheck before you even have a chance to miss it. Then, you have your full election amount available to you from day one, to cover everything from broken legs to cold medication.

aka the use-or-lose-it rule

How to reply: The anxiety behind this rule is completely understandable. Under it, contributions that have not been used to reimburse expenses incurred during a coverage period (usually a 12-month period) generally cannot be carried over to a subsequent plan year, and must be forfeited, unless an exception applies (see below). However, there are many ways to use up your FSA money before it has to be forfeited, if you’re organized and thoughtful in your approach – and exceptions to help you get the most out of it before funds expire are commonly offered by companies.

Every year, Pamela’s employer makes a $500 seed contribution to each employee’s calendar-year health FSA (yay!). For 2024, Pamela elects to put 2,700 toward her health FSA salary reductions, which meets the limit for the year. She receives her employer’s seed contribution, which means that her total health FSA contribution amount reaches $3,100. This will not violate the limit, as long as the $500 seed contribution is not received as cash or taxable benefits.

Now, if we follow Pamela’s story a little further, we find that her employment is terminated mid-year. She elects COBRA under the health FSA, and pays monthly after-tax premiums for her COBRA coverage for the remainder of 2019. Although Pamela will contribute more than $2,700 to her health FSA for 2019, her COBRA premiums are paid on an after-tax basis and will not be considered “salary reductions” subject to the limit.

Carryovers: An IRS guidance issued in 2013 allows health FSAs to offer carryovers of up to $610 at the end of a plan year to be used in the next plan year.

Grace period: Another exception allows plans to provide a 2.5 month grace period following the plan year. During the (amazing) grace period, participating employees can access unused amounts to pay or reimburse expenses for qualified benefits.

Qualified reservists: There’s a third exception for certain employees who are qualified reservists (called to active duty), which allows health FSAs to make some distributions.

While the use-it-or-lose-it rule may seem harsh and cause anxiety for some employees, really it is just ensuring that employees who participate in a health FSA will bear a risk of loss to what they would experience if they were paying premiums under an insurance policy. As an employer, it means that any forfeitures will be a gain under the health FSA that can offset losses to the plan.

How to reply: Unfortunately, most of us get sick, or have some other malady befall us at some point. Healthcare costs tend to be something you don’t think about until you have to. A transparency rule passed in April of 2018 by the Centers for Medicare and Medicaid Services required hospitals to post prices online — this shed some light for the public on exactly how high seemingly simple health issues can run.

Tara makes salary reduction contributions of $1,200 in her first plan year to a health FSA that does not provide for exceptions like carryovers or a grace period. During that plan year, she incurs only $1,000 of eligible medical expenses. That unused $200 is subject to the use-it-or-lose-it rule and cannot be carried over to her next plan year. In other words, Tara must forfeit her $200.

Stories began breaking in early 2019 when hospitals began adhering to the rule showing how vast the disparity in prices could be, depending on where you end up — for example, treating a headache without major complications cost $82,966 at a hospital in Florida, with lower ranges hitting at around $17k and $23k. Working alongside insurance, an FSA will help you to mitigate costs of a medical episode, so you can move on with your life.

Flexible Spending Accounts (FSAs) also provide coverage for unexpected essentials such as feminine products, over the counter medications, and sunscreen, broadening their scope to address a diverse range of healthcare-related expenses.

To pay approved claims made by plan participants, employers may set up a funding arrangement with a third-party and provide a bank account from which the claims amounts can be debited.

Claims must be paid with employer money. While we can’t speak specifically to what other companies may offer, to give you an idea of what is available, we’ll go over what funding option Ameriflex gives.

The Ameriflex Funding fee is a response to employers asking for a better cash management solution. The 4.99% fee is in lieu of a prefund. Instead of sending 1/12 of the total annual elected amount for a prefund, we collect 4.99% on each transaction total throughout the year as employees use their funds on eligible expenses. Your account is ACH debited once a day covering the claims activity amount + the Ameriflex funding fee of 4.99%.

Generally speaking, participation in a health FSA may be extended to any common-law employee of the employer. Most employers design their health FSAs so that they are only open to employees who are also eligible to participate in the major medical plan. This is because health FSAs generally (there are some exceptions if it’s integrated with another group health plan) must qualify as excepted benefits in order to comply with healthcare reform.

In order for your FSA to qualify as excepted benefits, you have to offer employees other non-excepted group health plan coverage – like major medical coverage – for a full year. This requirement is what the lawyers refer to as “the Availability Condition.” It’s what the rest of us call a good name for the next Mission Impossible movie. “A health FSA’s failure to qualify as an excepted benefit could result in excess taxes of $100 per participant per day or other penalties under healthcare reform, unless the health FSA is integrated with another group health plan under the same rules that apply to HRAs,” says Ameriflex Senior Counsel Donna M. Wilkinson.

Sidebar: Limited-scope dental/vision health FSAs will qualify as excepted, whether or not the availability condition is met. Make a mental note that this does not count for many HSA-compatible limited purpose health FSAs, which reimburse preventative care expenses as well as dental and vision care. Those would have to meet the availability condition in order to qualify as excepted benefits.

Bottom line: If you as an employer do not sponsor a major medical plan, you should not offer a health FSA unless it only provides limited-scope dental or vision benefits. It’s nice to want to offer a health FSA even if you don’t offer medical coverage, or give it to employees who aren’t eligible for medical coverage, but it could mean noncompliance, aka excess taxes and penalties. An alternative benefit is a Lifestyle Spending Account. LSAs are a means for employers to help their employees pay for health and wellness expenses, and sometimes other costs that aren’t typically covered under a group health plan.